Keep Dental Costs From Stealing Your Clients' Retirement

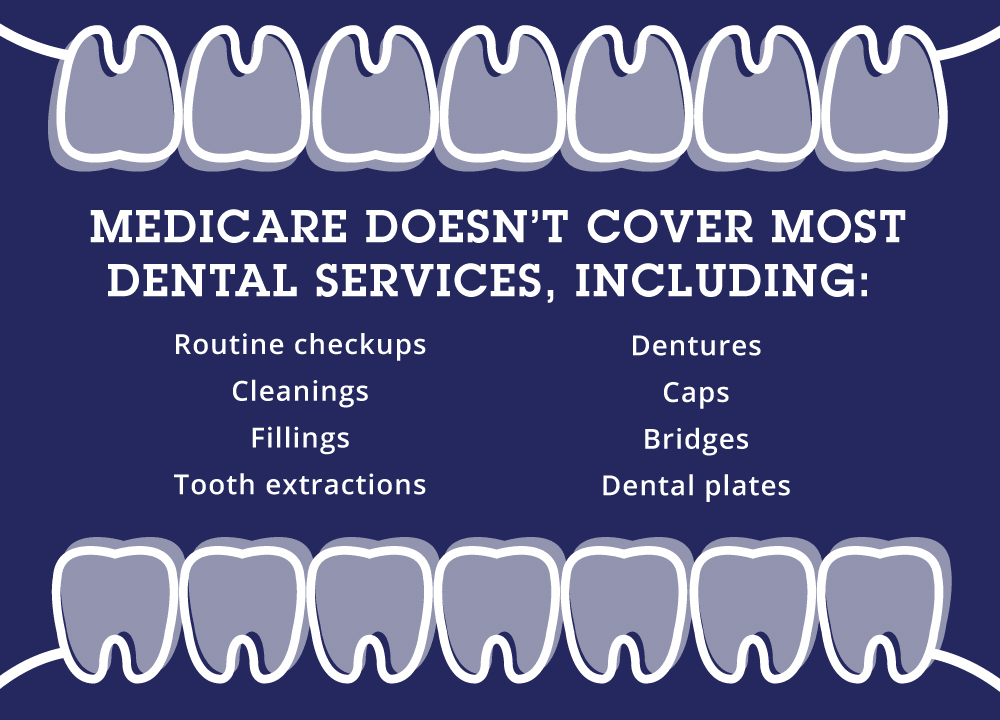

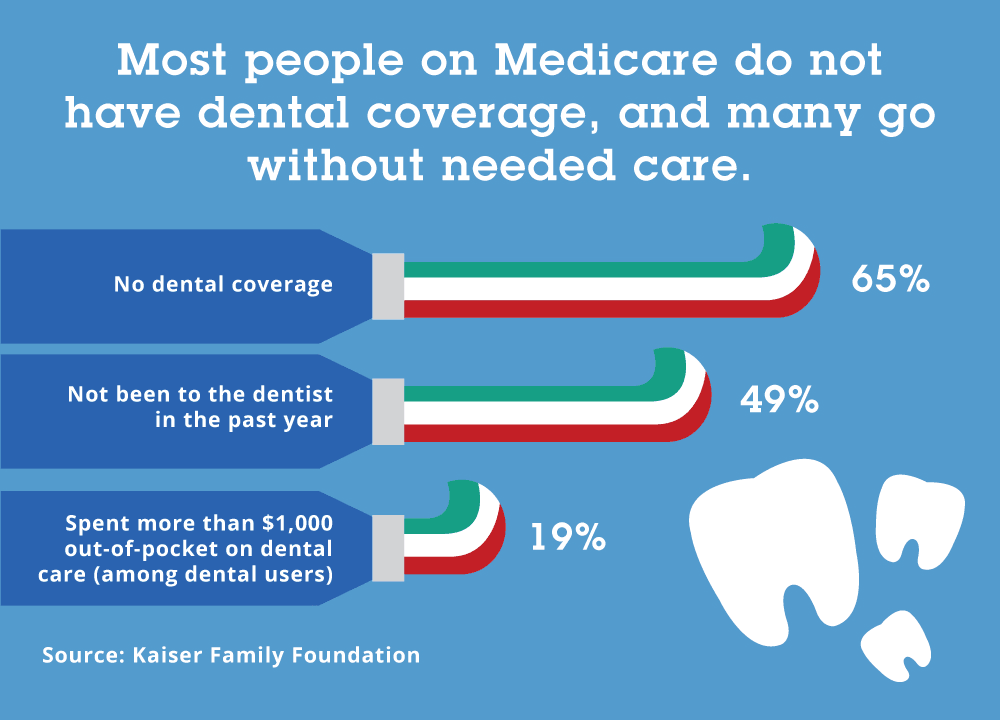

Many in the workforce are fortunate to have access to dental coverage through their employer. But what happens when they retire? Surely Medicare covers for dental, right? Wrong. Medicare doesn’t cover most dental services.

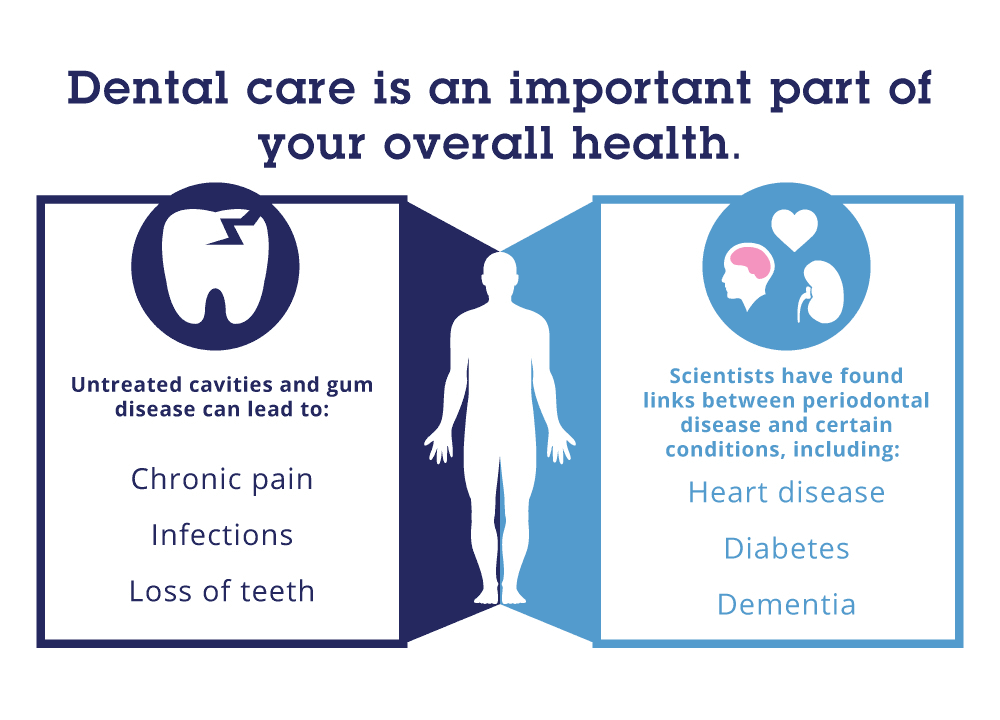

Yet, oral health is so important. Leaving cavities untreated isn’t wise. It can negatively affect how one eats and be detrimental to their speech. Also, if left untreated, cavities can lead to infections that could become severe and potentially fatal. Plus, dental care goes beyond the condition of one’s teeth. Poor dental health has been linked to an increased risk of heart disease, rheumatoid arthritis, diabetes and even dementia.

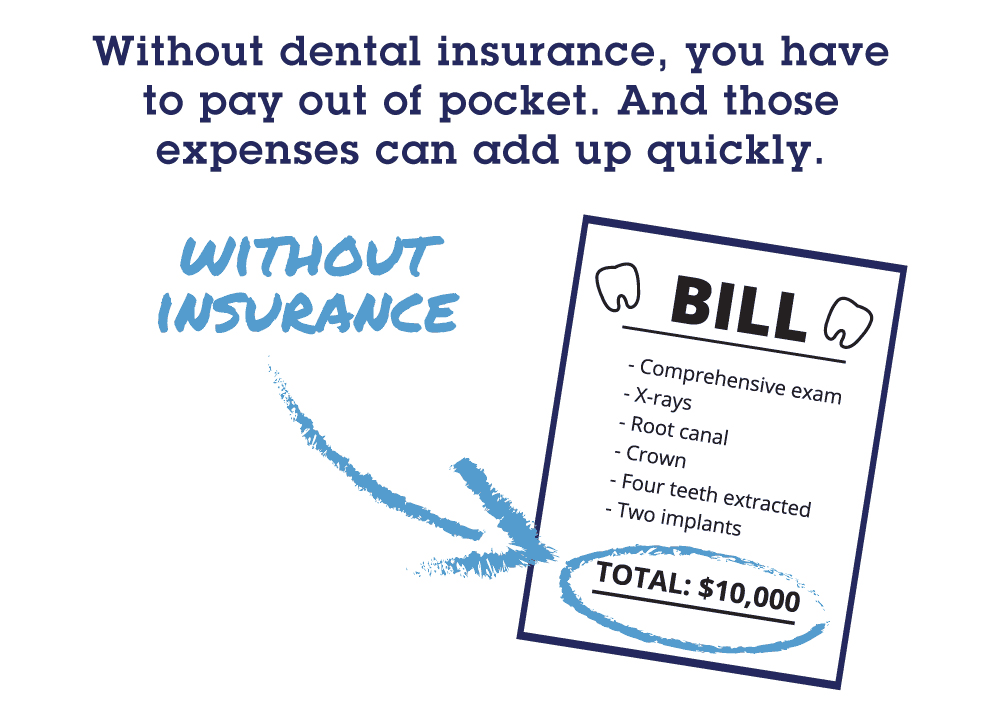

The cost of dental procedures isn’t cheap. With many retirees living on a fixed income, covering these procedures can be a burden. How do they maintain the dental health they deserve without emptying their wallet? One viable answer lies in dental insurance.

For Medicare-eligible individuals, dental insurance generally comes in two forms:

- Medicare Advantage plans with dental benefits*

- Standalone dental insurance plans

There are many dental insurance plan options to choose from through numerous insurance carriers. Features and benefits vary from plan to plan. They differ in what they cover, how much they cover, the amount of premiums required, etc. Additionally, some plans have waiting periods that must be met before coverage begins while others have caps on coverage, leaving policy owners responsible for expenses once they reach a certain amount.

With so many variables at play, how do clients know which dental plan is suitable for them? Also, how much should they pay to obtain said plan? To get the answers they need, they must do some research.

Clients must:

- Determine what they need and how much they're willing to pay in premiums

- Shop around and compare plans from more than one company

Doing these two things is crucial for clients who wish to obtain suitable coverage. But, it can also be a lot of work. Between shopping around, getting and comparing quotes, speaking with dental carrier representatives and making a decision, it can be exhausting.

That’s where you come in! They know you. They have a good professional relationship with you. You’ve helped them obtain other insurance solutions and therefore trust your judgment.

Here’s the problem. Dental insurance isn’t your bag. It’s not what you focus on. It’s not in your business plan or a part of your practice.

Here’s the solution! Fortunately, you can outsource this labor-intensive task to someone who has the time and licensure to partner with you and do the job on your behalf. Since they specialize in dental insurance options, they can help your clients quickly and efficiently. Plus, they keep your clients’ best interest at heart. What is this company? Medicare BackOffice®.

Medicare BackOffice is a good place to send your clients for dental insurance assistance. Its licensed agents can search multiple insurance company plans to find suitable dental coverage specifically tailored to any particular client need and budget. Your clients remain your clients. Medicare BackOffice simply partners with you to help them with dental insurance so that you can focus on what you do best.

If you’re interested in partnering with Medicare BackOffice, Call 1.877.385.8083. We’d love to speak with you.

An Added Bonus! Claim useful, client-facing information that you can use to help start the dental insurance conversation! It’s all courtesy of Medicare BackOffice.

A Little More About Medicare BackOffice

Medicare BackOffice is a team of licensed insurance agents who specialize in Medicare health plans and are dedicated to making the insurance shopping experience less confusing and less stressful. Our agents answer your clients’ Medicare questions and compare Medicare Supplement, Medicare Advantage and Medicare Part D Prescription Drug plans. They also offer assistance in obtaining dental insurance. They’ll assess your clients’ needs and help them find a plan that fits their unique situation and budget. Whether they’re enrolling in Medicare for the first time, reviewing their plan annually or just need dental coverage, our insurance experts can help them navigate the Medicare and dental insurance maze.

*Not all Medicare Advantage Plans offer dental benefits.

Not connected with or endorsed by the United States government or the federal Medicare program. The insurance services described on this website are provided by Insuractive, a Nebraska resident agency. Insuractive is also licensed as a non-resident insurance agency, or otherwise authorized to transact business as an insurance agency, in all states and the District of Columbia. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.